Single-Member LLC: A Smart Choice for Solopreneurs in 2024?

Starting a business is an exciting journey, and choosing the right structure is a crucial first step. For solopreneurs, the single-member LLC (SMLLC) offers a compelling blend of simplicity and protection. But is it the perfect fit for *you*? Let’s explore. Why SMLLCs are Popular Imagine this: you’re a freelance graphic designer with a thriving […]

S-Corp Self-Employment Tax: A Smart Strategy for Business Owners in 2024?

Running a business is no walk in the park. From managing daily operations to navigating the complexities of taxes, entrepreneurs face a myriad of challenges. One area that often causes confusion is S-Corp self-employment tax. While S-Corps offer attractive tax advantages, it’s crucial to understand the nuances to maximize benefits and avoid potential pitfalls, especially […]

4 Reasons to Maximize Section 179 Deduction in 2024

As a business owner, you’re always looking for ways to improve your bottom line. At XOA TAX, we often advise our clients to explore the significant tax advantages offered by Section 179 of the IRS tax code. This deduction allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed […]

Before Filing Form 3800: What Form Should You File First?

At XOA TAX, we’re passionate about helping businesses navigate the complexities of tax season. One common question we encounter revolves around Form 3800 – the General Business Credit. While it offers valuable opportunities to reduce tax liability, it often raises questions like: “What needs to be done *before* even considering Form 3800?” The key lies […]

Filing Business Taxes for an LLC for the First Time: Comprehensive Guide for 2024

Filing business taxes for your LLC can seem daunting initially, but with the right guidance, it becomes a manageable process. This guide will walk you through everything you need to know to successfully file your LLC’s taxes for the first time in 2024. Key Takeaways If you are the only owner of a limited liability […]

2024 Comprehensive Guide to Form W-2

Tax season can feel overwhelming, but understanding your W-2 is crucial for a smooth filing experience. This guide breaks down everything you need to know about Form W-2, from how to read it to what to do if there are errors. Get expert tax tips and maximize your refund with XOA Tax. Key Takeaways Your […]

How to Calculate Gross Income: A Comprehensive Guide for Individuals and Businesses

Understanding gross income is crucial for managing personal finances and running a successful business. This guide provides a clear breakdown of how to calculate gross income accurately, whether you’re an individual or a business owner. What is Gross Income? Why is Gross Income Important? Knowing your gross income is essential for: Calculating Gross Income Entity […]

1099-NEC vs 1099-MISC: Comprehensive Guide, Deadlines, and Filing Procedures

Use Form 1099-NEC for independent contractors and Form 1099-MISC for miscellaneous payments.

Conquering Schedule SE: Your Complete Guide to Self-Employment Tax in 2024

The entrepreneurial spirit is strong, and self-employment offers incredible freedom. But with that freedom comes the responsibility of understanding a unique set of tax rules, including those surrounding self-employment tax. This comprehensive guide will equip you with the knowledge to confidently navigate Schedule SE for the 2024 tax year. Key Takeaways: Schedule SE (Form 1040) […]

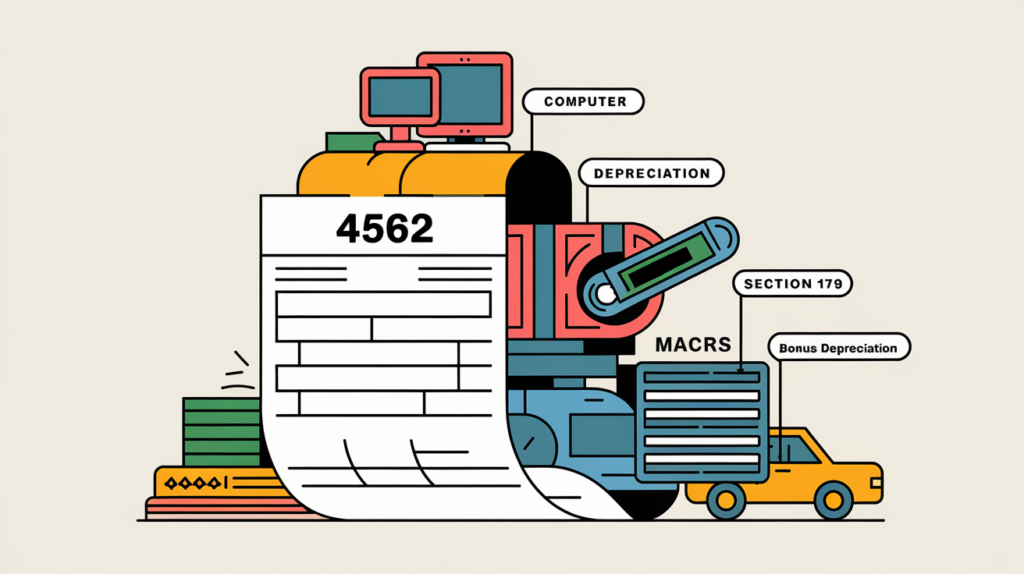

Form 4562: Your Guide to Depreciation and Amortization for the 2024 Tax Year

Tax season can be a challenging time for business owners, especially when it comes to navigating complex IRS forms. One such form that often causes confusion is Form 4562, Depreciation and Amortization. But don’t worry, we’re here to help! Understanding this form is crucial for unlocking valuable tax deductions and saving your business money. At […]