Insurance Bookkeeping: Best Practices for Agencies

Insurance is a complex business. You’re dealing with policies, premiums, claims, commissions, and a whole lot of paperwork. And as an insurance agent, your focus should be on your clients – helping them find the right coverage and navigating the complexities of the insurance world. But without solid bookkeeping practices, your agency could face financial […]

Maximizing Profitability in Dental Practices: A CPA’s Perspective

Running a profitable dental practice requires a keen understanding of both clinical excellence and sound financial management. This post provides actionable strategies for optimizing fee schedules, controlling overhead costs, streamlining the revenue cycle, leveraging technology, and ensuring compliance, ultimately leading to increased profitability and long-term financial success. Running a successful dental practice requires more than […]

The Role of Accounting in Business Strategy: More Than Just Numbers

At XOA TAX, we know that many business owners view accounting primarily as a compliance tool – necessary for tax season and little else. But accounting is so much more than that. It’s the financial backbone of your business strategy, providing the insights you need to make informed decisions and achieve your goals. Key Takeaways: […]

Implementing Internal Controls to Prevent Fraud: A Guide for Businesses

At XOA TAX, we believe that a healthy business is a protected business. While focusing on growth is essential, safeguarding your company from fraud is equally critical. Fraud can take many forms, from skimming cash and falsifying expense reports to more complex schemes like manipulating financial statements. It can cripple a business financially and damage […]

The Secret Ingredient Most Business Owners Miss (and How to Get It!)

Hey there, fellow entrepreneurs! Ever feel like you’re crushing it in your business, but still have this nagging feeling that something’s missing? Like you’re leaving money on the table or missing out on opportunities? I get it. We pour our hearts and souls into our businesses, but sometimes, the thing that truly sets us up […]

Rental Property Bookkeeping: A Clear Guide for Real Estate Investors

Investing in rental properties can be a smart move financially, but it also comes with its share of complexities, especially when it comes to managing your finances. Accurate and organized bookkeeping is absolutely essential for any successful real estate investor. It allows you to track income and expenses, make informed decisions about your properties, and, […]

Streamline Your E-commerce: Integrating QuickBooks with Shopify

Streamline your Shopify store’s finances by integrating QuickBooks for automated bookkeeping, reduced errors, and improved financial insights, saving you time and boosting accuracy.

Is Your Business Safe from Check Fraud?

Combating check fraud requires a multi-layered approach combining education, controls, technology, and digital payments.

Unlock Hidden Savings: Mastering Bookkeeping for Maximum Tax Deductions in 2024

Master bookkeeping techniques to maximize tax deductions and keep more money.

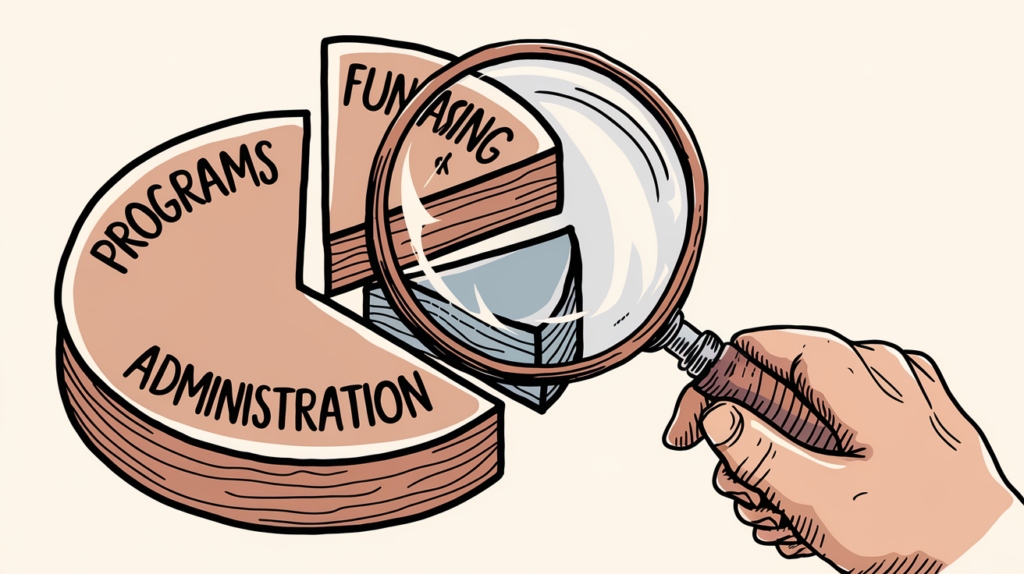

Navigating Nonprofit Accounting: Best Practices and Compliance

Master fund accounting, prioritize transparency, and stay compliant with regulations.