Streamlining Your Bookkeeping with Square

As a small business owner, you’re always looking for ways to streamline operations and improve efficiency. One area where technology can be a game-changer is bookkeeping. Square, known for its point-of-sale systems, offers a suite of tools that can simplify your financial management and integrate seamlessly with popular accounting software. This post will explore how […]

Nail Salon Accounting & Financial Management: Expert Solutions for Your Beauty Business

Running a successful nail salon takes more than just talent and artistry. It requires a solid understanding of your finances. Think of it this way: your creativity is the polish, and sound financial management is the base coat – essential for a long-lasting, chip-free business! At XOA TAX, we believe that a strong financial foundation […]

Outsourcing Controller Services: A Smart Move for Your Business?

As a business owner, your time is valuable. You’re constantly juggling priorities, from managing operations and driving sales to ensuring compliance and planning for the future. One area where you can strategically free up time and resources is by outsourcing your controller services. At XOA TAX, we understand the complexities businesses face, and we’re here […]

Handling Client Trust Accounts: Best Practices for Insurance Professionals

Insurance professionals often manage funds belonging to their clients—premiums, claims payments, and escrowed funds. These funds require careful handling and transparency to maintain compliance and client trust. This post explores best practices for managing client trust accounts, ensuring ethical and legal fund management. Key Takeaways Understand your jurisdiction’s regulatory requirements for client trust accounts. Implement […]

Implementing Job Costing in Professional Services Firms

In the competitive landscape of professional services, understanding the profitability of individual projects or clients is paramount. This is where job costing becomes an invaluable tool. Job costing is an accounting method that allows firms like law firms, marketing agencies, and consulting firms to track and allocate costs to specific projects or clients. By implementing […]

Navigating the Labyrinth: Returns and Refunds in E-commerce Accounting

The e-commerce boom has transformed the retail landscape, offering unprecedented opportunities for businesses of all sizes. However, this digital shift comes with unique challenges, particularly when it comes to managing returns and refunds. For e-commerce businesses, understanding the financial implications of these transactions and accurately accounting for them is paramount for maintaining a healthy bottom […]

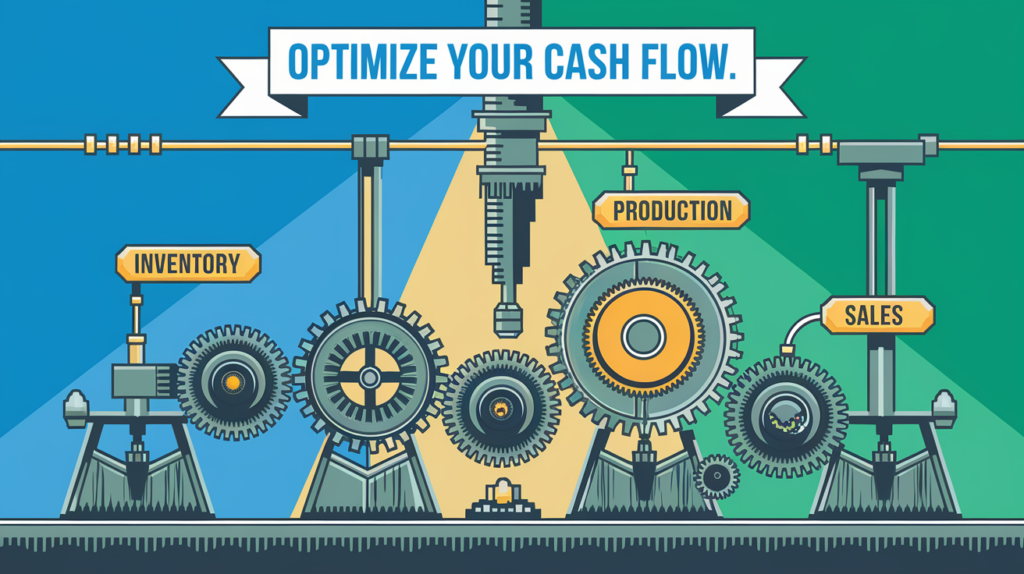

Cash Flow Management for Manufacturing: A CPA’s Guide

Cash flow is the engine that drives growth and stability in manufacturing. Without it, production grinds to a halt. At XOA TAX, we understand the financial intricacies of the manufacturing world. This blog post equips you with actionable strategies to optimize your cash flow and enhance operational efficiency. Key Takeaways Control production costs through strategic […]

Restaurant Tax Compliance: Sales Tax, Payroll, & Regulations

The restaurant industry is a dynamic and exciting field, but it also comes with unique financial challenges. Restaurant owners must juggle various tax and payroll obligations while ensuring they comply with all applicable regulations. This blog post provides a comprehensive guide to help restaurant owners navigate these complex areas, covering everything from sales tax and […]

Struggling with Discrepancies in QuickBooks? Here’s How to Get Your Balance Sheet in Shape

QuickBooks is a fantastic tool for small business owners, helping to simplify accounting tasks and keep your financial records in order. However, even the best software isn’t immune to errors, and discrepancies can appear in your balance sheet. These inconsistencies can disrupt your financial reports and lead to costly mistakes. At XOA TAX, we understand […]

Understanding the Wash Sale Rule and Its Impact on Your Taxes (2024)

The wash sale rule can be a bit of a head-scratcher for many taxpayers. It might seem straightforward at first glance, but it can have a real impact on how much you owe come tax time. As CPAs, we at XOA TAX want to make sure you’re well-equipped to navigate this rule. So, let’s break […]